Summary | Excerpt | Reviews | Readalikes | Genres & Themes | Author Bio

"Once government got a taste of money, the appetite grew," said rich dad. "Your dad and I are exactly opposite. He's a government bureaucrat, and I am a capitalist. We get paid, and our success is measured on opposite behaviors. He gets paid to spend money and hire people. The more he spends and the more people he hires, the larger his organization becomes. In the government, the larger his organization, the more he is respected. On the other hand, within my organization, the fewer people I hire and the less money I spend, the more I am respected by my investors. That's why I don't like government people. They have different objectives from most business people. As the government grows, more and more tax dollars will be needed to support it."

My educated dad sincerely believed that government should help people. He loved John F. Kennedy and especially the idea of the Peace Corps. He loved the idea so much that both he and my mom worked for the Peace Corps training volunteers to go to Malaysia, Thailand and the Philippines. He always strived for additional grants and increases in his budget so he could hire more people, in his job with the Education Department and in the Peace Corps. That was his job.

From the time I was about 10 years old, I would hear from my rich dad government workers were a pack of lazy thieves, and from my poor dad I would hear how the rich were greedy crooks who should be made to pay more taxes. Both sides have valid points. It was difficult to go to work for one of the biggest capitalists in town and come home to a father who was a prominent government leader. it was not easy knowing who to believe.

Yet, when you study the history of taxes, an interesting perspective emerges. As I said, the passage of taxes was only possible because the masses believed in the Robin Hood theory of economics, which was to take from the rich and give to everyone else. The problem was that the government's appetite for money was so great that taxes soon needed to be levied on the middle class, and from there it kept "trickling down." The rich, on the other hand, saw an opportunity. They do not play by the same set of rules. As I've stated, the rich already knew about corporations, which became popular in the days of sailing ships. The rich created the corporation as a vehicle to limit their risk to the assets of each voyage. The rich put their money into a corporation to finance the voyage. The corporation would then hire a crew to sail to the New World to look for treasures. If the ship was lost, the crew lost their lives, but the loss to the rich would be limited only to the money they invested for that particular voyage. The diagram that follows shows how the corporate structure sits outside your personal income statement and balance sheet.

It is the knowledge of the power of the legal structure of the corporation that really gives the rich a vast advantage over the poor and the middle class. Having two fathers teaching me, one a socialist and the other a capitalist, I quickly began to realize that the philosophy of the capitalist made more financial sense to me. It seemed to me that the socialists ultimately penalized themselves, due to their lack of financial education. No matter what the "Take from the rich" crowd came up with, the rich always found a way to outsmart them. That is how taxes were eventually levied on the middle class. The rich outsmarted the intellectuals, solely because they understood the power of money, a subject not taught in schools.

How did the rich outsmart the intellectuals? Once the "Take from the rich" tax was passed, cash started flowing into government coffers. Initially, people were happy. Money was handed out to government workers and the rich. It went to government workers in the form of jobs and pensions. It went the rich via their factories receiving government contracts. The government became a large pool of money, but the problem was the fiscal management of that money. There really is no re-circulation. In other words, the government policy, if you were a government bureaucrat, was to avoid having excess money. If you failed to spend your allotted funding, you risked losing it in the next budget. YOU would certainly not be recognized for being efficient. Business people, on the other hand, are rewarded for having excess money and are recognized for their efficiency.

Copyright © 1997, 1998 by Robert T. Kiyosaki and Sharon L. Lechter

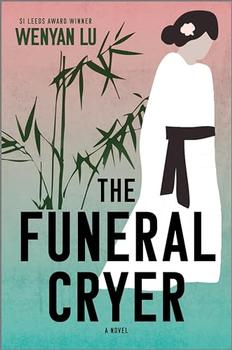

The Funeral Cryer by Wenyan Lu

Debut novelist Wenyan Lu brings us this witty yet profound story about one woman's midlife reawakening in contemporary rural China.

Your guide toexceptional books

BookBrowse seeks out and recommends the best in contemporary fiction and nonfiction—books that not only engage and entertain but also deepen our understanding of ourselves and the world around us.